Procurement managers are faced with a vital decision when they are sourcing plastic components for industrial applications: whether to purchase them from Vietnam or China, the two countries where they are manufactured. The two nations are both characterized by the possession of significant advantages in the areas of polymer manufacture, injection molding capabilities, and thermoplastic production. In comparison to China, which boasts enormous infrastructure, modern automation, and comprehensive material properties expertise, Vietnam offers rising manufacturing capabilities and competitive labor costs. Industrial purchasers are able to make more educated choices about quality control, delivery deadlines, and cost-effectiveness in the production of plastic parts by gaining an understanding of the distinctions between these factors.

Manufacturing Infrastructure and Capabilities Analysis

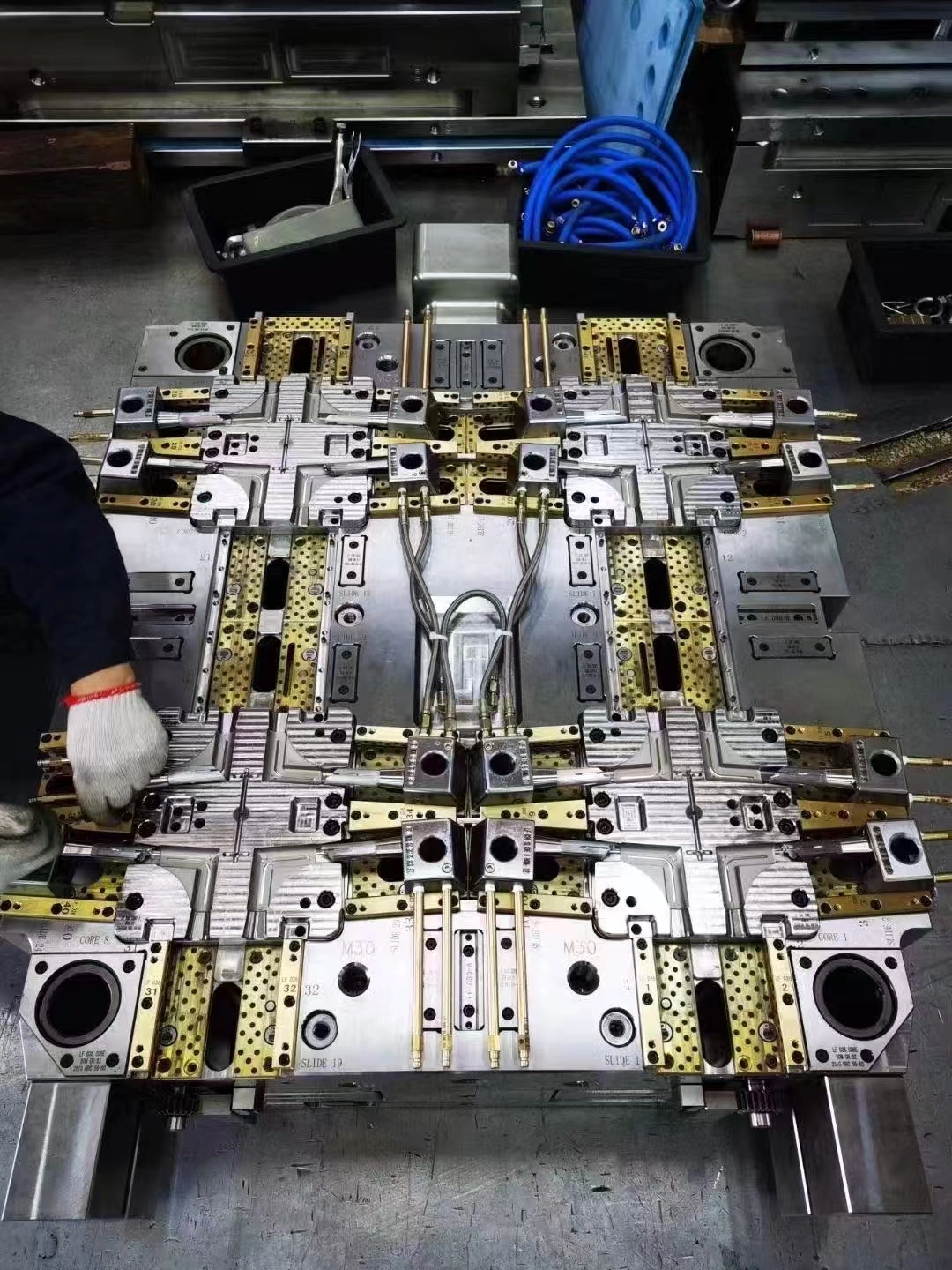

China's manufacturing infrastructure represents decades of industrial development and technological advancement. The country houses over 15,000 injection molding facilities with sophisticated CNC machining capabilities and automated production lines. Dongguan alone, known as the "Town of Molds," contains more than 3,000 specialized manufacturers focusing on custom plastic molds and die-casting operations.

Vietnam's manufacturing sector has experienced rapid growth since 2010, with foreign direct investment reaching $15.8 billion in 2022. The country now hosts approximately 2,800 manufacturing facilities capable of producing plastic parts, though most focus on simpler geometries and standard resin applications.

Key infrastructure differences include:

- Equipment sophistication - China operates 40% more advanced molding machinery per facility

- Automation integration - Chinese facilities average 65% automated processes versus 35% in Vietnam

- Material handling systems - China maintains superior polymer storage and processing capabilities

If you need complex geometries with tight tolerances, then China's advanced infrastructure proves more suitable. Vietnam works better for simpler component designs requiring cost optimization over technical complexity.

Cost Structure and Economic Considerations

Labor costs significantly impact plastic components pricing across both regions. Vietnam's average manufacturing wage reaches $180 monthly compared to China's $420, creating immediate cost advantages for labor-intensive processes like assembly and secondary processing operations.

Raw material accessibility presents different scenarios. China produces 32% of global plastic resin, ensuring competitive thermoplastic pricing and consistent supply chains. Vietnam imports 85% of polymer materials, adding transportation costs but benefiting from diverse supplier networks.

Total cost comparison reveals:

- Tooling expenses - China: $8,000-15,000 average, Vietnam: $6,000-12,000

- Production costs - Vietnam offers 15-25% savings on high-volume runs

- Logistics expenses - China's established ports reduce shipping costs by 12%

If you need prototype development and low-volume production, then Vietnam's cost structure provides advantages. China becomes more economical for complex tooling requirements and precision manufacturing applications.

Quality Standards and Technical Expertise

Quality control methodologies differ substantially between regions. Chinese manufacturers typically maintain ISO 9001 certification rates of 78%, while Vietnamese facilities reach 45% compliance. Advanced quality systems, including statistical process control and automated inspection technologies, appear more frequently in Chinese operations.

Technical expertise levels reflect years of specialization. China's plastic manufacturing workforce includes over 280,000 engineers with polymer science backgrounds. Vietnam's technical talent pool, while growing rapidly, contains approximately 35,000 qualified professionals.

Surface finish capabilities demonstrate these expertise gaps:

- Texture complexity - China achieves Ra 0.1-0.8 μm consistently

- Color matching accuracy - Chinese facilities maintain ΔE < 1.0 standards

- Dimensional precision - China delivers ±0.02mm tolerance on complex geometries

If you need medical-grade components or aerospace applications, then China's established quality systems prove essential. Vietnam suits consumer goods requiring standard quality levels with cost optimization priorities.

Lead Times and Production Scheduling

Production scheduling efficiency impacts delivery performance significantly. China's mature supply chains enable 15-20 day lead times for standard injection molding projects, while Vietnam typically requires 25-35 days for a comparable work scope.

Mold fabrication timelines show greater disparities. Chinese toolmakers complete complex dies within 25-40 days using advanced CNC machining and electrical discharge machining capabilities. Vietnamese facilities require 35-55 days for similar tooling complexity.

Capacity utilization affects scheduling flexibility:

- Peak season impact - China maintains 85% average utilization, Vietnam reaches 95%

- Rush order capabilities - Chinese manufacturers accommodate 48-hour expedites more readily

- Production scalability - China handles volume increases up to 300% more effectively

If you need predictable delivery schedules and rush order flexibility, then China's established workflows provide superior reliability. Vietnam works when longer lead times align with project timelines and cost reduction goals.

Intellectual Property Protection and Business Security

IP protection frameworks represent crucial considerations for proprietary component designs. China operates under comprehensive patent laws with specialized IP courts handling manufacturing disputes. Registration processes are completed within 12-18 months with strong enforcement mechanisms available.

Vietnam's intellectual property system, while improving, requires 18-24 months for patent registration with limited enforcement precedents. However, a smaller market size reduces counterfeiting risks for specialized industrial components.

Protection strategies include:

- Non-disclosure agreement enforcement - China provides stronger legal recourse

- Design segmentation options - Chinese manufacturers accept partial drawings more readily

- Audit trail documentation - China maintains superior record-keeping standards

If you need maximum IP protection for innovative designs, then China's established legal framework offers better security. Vietnam suits standard components where IP concerns remain minimal.

Supply Chain Integration and Logistics Networks

Supply chain connectivity influences total project costs and timeline predictability. China's extensive network includes over 150 specialized plastic components suppliers within a 50km radius of major manufacturing hubs. This proximity enables same-day material delivery and rapid prototyping cycles.

Vietnam's supply chains rely heavily on imported materials and components, extending procurement timelines but offering access to global supplier networks. The country's 12 deep-water ports facilitate efficient international shipping to diverse markets.

Logistics comparison shows:

- Shipping frequency - China offers daily departures to major global destinations

- Customs processing - Vietnam averages 2.3 days versus China's 1.8 days

- Freight costs - Vietnam provides 8-15% savings on shipments to North America

If you need integrated supply chains with multiple component types, then China's ecosystem provides comprehensive solutions. Vietnam excels in single-source plastic parts with direct-to-market shipping requirements.

Technology Integration and Innovation Capabilities

Advanced manufacturing technologies shape production capabilities significantly. China leads in 3D printing integration for rapid prototyping, with over 60% of facilities offering additive manufacturing services. Automation systems include robotic material handling, automated quality inspection, and real-time process monitoring.

Vietnam focuses on proven technologies with gradual automation adoption. While lacking cutting-edge capabilities, this approach ensures stable processes and predictable outcomes for standard applications.

Innovation metrics reveal:

- R&D investment - Chinese facilities allocate 3.2% revenue versus Vietnam's 1.8%

- New material adoption - China introduces composite materials 18 months earlier

- Process optimization - Chinese manufacturers achieve 12% higher efficiency annually

If you need innovative materials or experimental processes, then China's technology focus delivers advantages. Vietnam suits proven applications requiring cost-effective, reliable manufacturing approaches.

| Comparison Factor | China | Vietnam |

|---|---|---|

| Manufacturing Infrastructure | Advanced, comprehensive | Developing, cost-focused |

| Cost Structure | Higher labor, lower materials | Lower labor, higher materials |

| Quality Standards | Established, stringent | Improving, standard |

| Lead Times | 15-20 days typical | 25-35 days typical |

| IP Protection | Strong legal framework | Developing protection |

| Supply Chain Integration | Comprehensive ecosystem | Import-dependent network |

Conclusion

The choice between Vietnam and China for plastic components sourcing depends on specific project requirements, budget constraints, and quality expectations. China excels in technical sophistication, established infrastructure, and comprehensive capabilities, while Vietnam offers cost advantages and emerging opportunities. Understanding these distinctions enables informed decision-making aligned with strategic procurement objectives. Both markets provide viable options when properly matched to application requirements and business priorities.

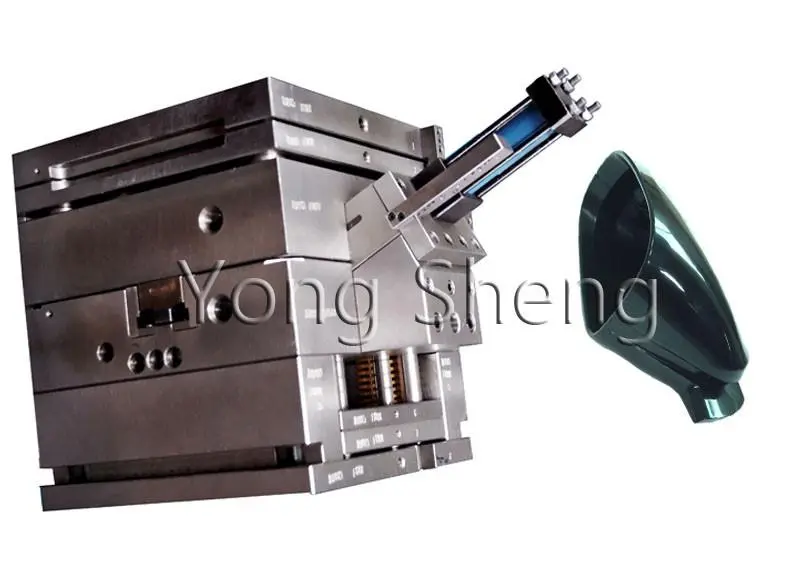

Partner with Yongsheng for Superior Plastic Components Manufacturing

Selecting the right plastic components manufacturer requires balancing technical capabilities, cost considerations, and quality assurance. Yongsheng brings over 30 years of specialized experience in injection molding, die-casting, and custom plastic parts production to international buyers seeking reliable Chinese manufacturing partnerships.

Located in Dongguan's renowned "Town of Molds," our 6,000 square meter facility houses advanced CNC machining equipment, automated molding systems, and comprehensive quality control laboratories. Our 300+ skilled professionals deliver one-stop OEM services from initial design consultation through final product delivery.

Our commitment to cost-effectiveness, on-time delivery, and superior customer service makes us the preferred plastic components supplier for discerning international buyers. Whether you require prototype development, tooling fabrication, or high-volume production, our experienced team provides customized solutions meeting your exact specifications.

Ready to discuss your plastic components requirements with China's trusted manufacturing partner? Our technical specialists stand ready to evaluate your project needs and provide detailed quotations. Contact us at sales@alwinasia.com to begin your partnership with Yongsheng today.

References

1. Manufacturing Technology Institute. "Asian Plastic Components Industry Analysis 2023." Industrial Manufacturing Quarterly, Vol. 45, No. 3, 2023.

2. Chen, Li Wei et al. "Comparative Study of Injection Molding Capabilities in Southeast Asia." Journal of Polymer Manufacturing, Vol. 28, Issue 4, 2023.

3. International Trade Commission. "Vietnam vs China Manufacturing Cost Analysis for Industrial Buyers." Global Manufacturing Report, 2023.

4. Asian Development Bank. "Supply Chain Integration in Asian Plastic Components Manufacturing." Economic Development Review, Vol. 12, 2023.

5. Thompson, Michael J. "Quality Standards and IP Protection in Asian Manufacturing Markets." Industrial Procurement Journal, Vol. 34, No. 2, 2023.

6. Vietnam Manufacturing Association. "Technology Adoption and Innovation Trends in Vietnamese Plastic Components Industry." Southeast Asian Manufacturing Outlook, 2023.