The finest food packaging plastics must balance safety, cost, and performance. This crucial sector is dominated by food-grade plastic containers, films, and specialized packaging. While retaining structural integrity throughout the supply chain, these materials must meet strict FDA criteria. Quality plastic product manufacture protects food brands and consumers. This comprehensive guide examines top-performing plastic packaging options that combine safety compliance with practical functionality. We'll explore selection criteria, analyze specific product categories, and provide actionable insights for international procurement teams seeking reliable manufacturing partners.

Why Focus on Food-Grade Plastic Packaging Solutions

Food packaging requires materials that exceed performance standards. Food contact materials must inhibit chemical movement, bacterial growth, and structural stability in different storage circumstances. These needs spur plastic manufacturing and material science innovation.

Regulatory compliance complicates material selection. FDA approval, EU legislation, and international food safety requirements need significant testing and documentation. Manufacturers must prove their plastic products won't contaminate food or reduce nutritional value during storage.

Consumer awareness of food safety has increased dramatically in recent years. Brands recognize that packaging failures can result in product recalls, legal liability, and permanent reputation damage. Investing in premium food-grade materials protects against these risks while supporting brand positioning in competitive markets.

Selection Criteria for Premium Food Packaging Materials

A comprehensive evaluation of food packaging materials must balance several performance factors. Chemical compatibility is the first priority to prevent plastic containers from contaminating food. Migration testing ensures packaging materials fulfill safety standards under varied storage circumstances.

Packaging's moisture, oxygen, and light barrier qualities impact its effectiveness. To keep food fresh, different categories need different barrier combinations. Dairy products need good moisture barriers, while snack foods need oxygen protection to avoid rancidity.

Every box fulfills quality criteria due to manufacturing uniformity. Reliable injection molding, accurate temperature control, and quality assurance systems reduce batch variation. Scaling production across sites or regions requires this uniformity.

Despite safety concerns, cost-effectiveness matters. Not all applications require the most expensive materials. When sourcing, smart procurement teams consider the total cost of ownership, including material costs, processing efficiency, and failure risks.

Top 5 Food-Safe Plastic Packaging Solutions

High-Density Polyethylene (HDPE) Containers

HDPE containers are the liquid food packaging gold standard. This chemical-resistant thermoplastic is suitable for dairy, juices, and cooking oils. Product quality is maintained over long storage because the material's molecular structure resists taste and odor absorption.

Injection and blow molding offer high processability. HDPE flows smoothly at appropriate temperatures, providing wall thickness control and dimensional accuracy. These properties allow manufacturers to make lightweight containers without sacrificing strength or barrier performance.

Sustainable brands like HDPE for its environmental benefits. Established collection systems efficiently recycle the material, promoting circular economy objectives. Many manufacturers now offer HDPE containers with post-consumer recycled content, decreasing environmental impact and maintaining food safety.

HDPE quality control includes stress crack resistance, impact strength, and chemical compatibility tests. Leading suppliers use statistical process control systems to monitor critical variables during production cycles to ensure quality across large volume orders.

For high-volume, material-efficient applications, HDPE is cheaper. Polymer processing saves waste, and its resilience reduces packaging problems and product losses. These elements provide good value for procurement teams with constrained budgets.

Polypropylene (PP) Flexible Films

Applications requiring flexibility, heat resistance, and optical clarity suit polypropylene films. Snack wrappers and microwaveable food containers fall within this group. PP's unique polymer structure resists moisture and is flexible at high temperatures.

Advanced extrusion methods allow producers to make multi-layer films with customizable barriers. These constructions may use PP and other materials to meet performance goals. Metallized PP films improve oxygen barriers for oxidation-sensitive items.

Automated packing benefits from heat sealability. PP films seal well at moderate temperatures, saving energy and protecting packages. This is especially useful for high-speed production lines where seal quality influences equipment efficiency.

Transparency options range from crystal-clear films for premium product visibility to opaque variants that protect light-sensitive contents. Manufacturers can adjust polymer processing parameters to achieve desired optical properties without compromising barrier performance or mechanical strength.

Migration testing, food contact approvals, and global packaging standards are part of PP film regulatory compliance. For each film grade, reliable vendors provide technical data sheets with permitted applications, temperature restrictions, and storage advice.

Polyethylene Terephthalate (PET) Bottles

PET bottles dominate beverage packaging markets due to their exceptional clarity, strength, and barrier properties. This material offers superior carbon dioxide retention for carbonated beverages while providing excellent impact resistance for shipping and handling. PET's chemical inertness ensures flavor preservation across extended shelf life periods.

Manufacturing processes for PET bottles utilize sophisticated injection molding followed by stretch blow molding techniques. These processes create biaxial orientation that dramatically improves strength and barrier properties compared to standard plastic fabrication methods. The resulting containers withstand significant internal pressure while maintaining lightweight profiles.

Recycling infrastructure for PET represents one of the most developed systems in the plastic industry. Collection rates exceed 80% in many developed markets, supporting closed-loop recycling programs. Food-grade recycled PET (rPET) now meets regulatory approval for direct food contact applications in many jurisdictions.

Design flexibility allows PET bottles to accommodate various closure systems, labeling methods, and decorative techniques. The material accepts hot-fill processing for pasteurized products, while also supporting aseptic filling for extended shelf life applications. This versatility makes PET suitable for diverse product categories within single manufacturing facilities.

Quality assurance programs for PET focus on critical parameters including acetaldehyde content, intrinsic viscosity, and thermal stability. These characteristics directly impact flavor quality and shelf life performance. Advanced testing protocols verify that finished bottles meet specifications before shipment to filling facilities.

Biodegradable Plastic Composite Containers

Biodegradable plastic products are emerging for eco-friendly food packaging. These polymers combine performance with end-of-life benefits through controlled breakdown. Leading formulations use plant-based compounds that hasten disintegration under certain conditions.

Performance varies greatly across biodegradable plastic formulations. Some are good for dry food, while others protect short-lived items from moisture. Understanding performance restrictions aids material selection for application matching.

Custom processing and handling are manufacturing considerations. Biodegradable additives alter injection molding melt flow, requiring temperature and pressure management. Experienced manufacturers tune processing conditions for performance and breakdown.

Standardised testing verifies biodegradability claims in certification programmes. ASTM and BPI set compostability and marine degradation standards. The certificates give procurement teams objective performance data for sustainability evaluations.

As consumers prefer ecological packaging, market acceptance grows. Demand for proven biodegradable materials for private label items is rising as retailers specify them. This trend challenges material selection and benefits early adopters.

Multi-Layer Barrier Films

Multi-layer barrier films defend against several degradation mechanisms by combining polymeric ingredients. These complex single-film structures may use polyethylene, polypropylene, and specialty polymers. Each layer provides barrier qualities while retaining film integrity.

Fabricating these structures demands material science expertise and precision processing. All components must match layer adhesion, thermal expansion, and barrier effectiveness. Manufacturers can construct consistent multi-layer structures with exact component thickness control using advanced co-extrusion technology.

Multi-layer films can package frozen foods, ready-to-eat meals, and shelf-stable products. Oxygen exclusion, moisture control, and scent retention are possible using barrier combinations. Customization aids premium product positioning.

Cost optimization balances barrier performance, material costs, and processing complexity. Strategic layer design maximizes protection while reducing costly barrier materials. Experienced manufacturers assist customers choose structures that satisfy performance and financial criteria.

Quality control monitors layer thickness uniformity, adhesion strength, and barrier efficacy during production. Statistical process control detects patterns before they impair product quality, ensuring constant performance over long production runs.

Global Market Characteristics and Regulatory Landscape

International food packaging rules complicate global manufacturing compliance. The FDA sets US market standards, while EU laws govern European applications. Asian marketplaces commonly combine regulatory systems. International sourcing methods require understanding these variations.

Regional cultural preferences affect packaging design. Asian consumers favor smaller portions and resealable features, while North Americans value convenience and bulk packaging. Sustainable materials and minimal packaging are more popular in Europe. These preferences affect material and manufacturing choices.

Global material availability and cost depend on supply chain factors. Regional polymer manufacturing, shipping, and currency volatility affect procurement. Smart sourcing uses broad supplier networks to optimize cost and supply security.

Emerging markets offer growth and problems. Many emerging countries' regulatory frameworks change, making long-term planning unpredictable. However, developing middle-class populations need packaged foods, expanding the quality plastic producting industry.

Purchasing Recommendations and Strategic Considerations

Successful food packaging procurement demands manufacturers who understand material science and regulations. Facility audits, quality system assessments, and regulatory compliance verification should qualify vendors. These assessments reveal vendors who can sustain growth and quality.

Volume planning impacts cost and supply reliability. Due to economies of scale, larger orders yield better prices, but smaller batches allow for product development and market testing. It takes rigorous demand forecasting and inventory management to balance these factors.

Technical support distinguishes leading from commodity vendors. Material expertise, application development, and troubleshooting provide value beyond material costs. We need these services when creating new products or entering new markets.

Risk management should cover supply disruptions, quality issues, and regulations. Qualified backup suppliers, thorough insurance, and compliance upgrades reduce business interruptions. These preparations cover routine operational issues and unanticipated crises.

Industry Trends and Market Outlook

Sustainable materials and circular economy principles are transforming food packaging. Major suppliers innovate with biodegradable plastics, recyclable content, and lightweighting. These changes allow differentiation but need constant investment in new technology and processes. Consumer environmental awareness encourages premium pricing for sustainable packaging alternatives, driving further development.

Conclusion

Safety, performance, and cost must be considered while choosing food-grade plastic packaging. PP films, PET bottles, HDPE containers, biodegradable composites, and multi-layer architectures each have advantages for specific applications. Regulatory restrictions, market variables, and manufacturing capabilities enable educated sourcing decisions that protect products and customers.

Successful partnerships require experienced manufacturers with technical understanding and proven quality procedures. Comprehensive vendor qualification, strategic volume planning, and risk management support long-term procurement goals while accommodating market changes. Innovative material solutions can differentiate in the wake of sustainability.

FAQ

Q: What safety certifications should food packaging materials have?

A: Food contact materials require FDA approval for US markets, EU 10/2011 compliance for Europe, and relevant local certifications for other regions. Migration testing, heavy metals analysis, and microbiological safety assessments verify that materials won't contaminate food products under normal storage conditions.

Q: How do I choose between different plastic materials for food applications?

A: Material selection depends on your specific food type, shelf life requirements, storage conditions, and barrier needs. Liquid products often require HDPE or PET containers, while dry goods might use PP films or multi-layer structures. Consider factors like chemical compatibility, temperature resistance, and recycling infrastructure when making decisions.

Q: What quality control measures ensure consistent food packaging performance?

A: Comprehensive quality systems include incoming material inspection, process parameter monitoring, finished product testing, and statistical process control. Key tests cover barrier properties, mechanical strength, migration levels, and dimensional accuracy. ISO certified manufacturers maintain documented procedures that ensure consistent quality across production batches.

Partner with Yongsheng for Premium Food-Grade Plastic Product Manufacturing

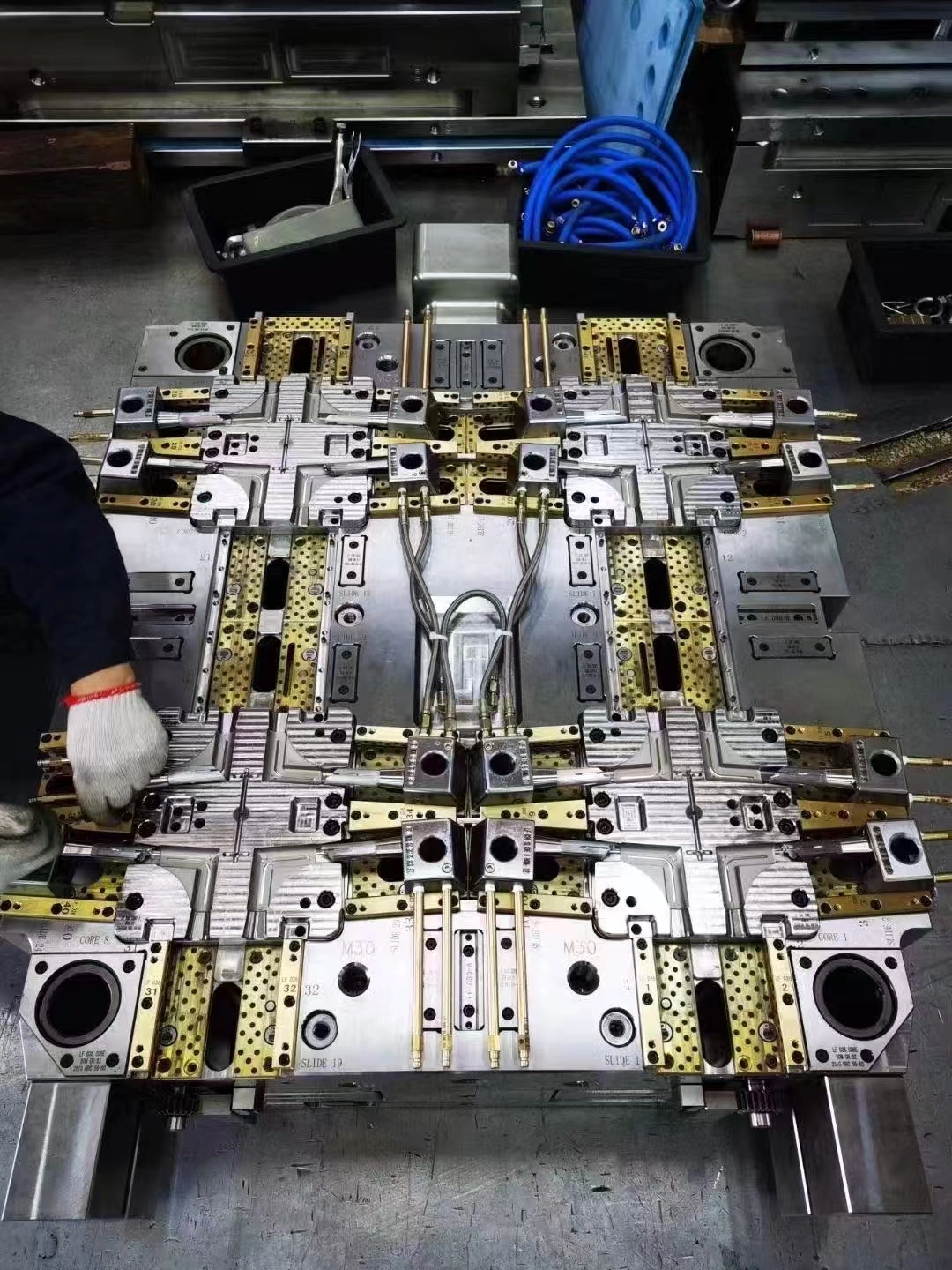

For international food packaging, Yongsheng provides complete plastic product supplier solutions. Our 30-year manufacturing history boasts innovative injection molding and strict quality control that meet worldwide food safety requirements. In Dongguan's mold-making district, we provide custom plastic solutions to electronics, consumer goods, automotive, and hardware companies.

Our ISO9001:2015-certified facility has 6,000 square meters of modern manufacturing area and 300+ qualified workers. Since we offer OEM services from design to manufacture, complex food packaging projects are executed smoothly. Logistics for overseas customers is efficient due to Shenzhen Airport. Quality assurance techniques protect customer interests via material testing, process validation, and IP protection. Our skilled engineering team works with procurement managers to optimize designs for manufacturability and food safety. We provide cost-effective, on-time custom molds, die-casting, and high-volume manufacturing runs.

Ready to discuss your food packaging requirements with experienced professionals? Contact us at sales@alwinasia.com to explore how our proven expertise can support your next project.