If you compare Vietnam and China as places to work together on tool making, China is clearly the better option for OEM buyers who want complete manufacturing solutions. China's manufacturing ecosystem has been around for 30 years and has precision tool making, advanced fabrication technologies, and well-established supply chains that Vietnam's infrastructure is still not ready to match. Vietnam has low labor costs and a growing manufacturing potential, but China is the best place for procurement managers who need reliable, scalable manufacturing partnerships with strong IP protection frameworks. This is because China has mature tool making engineering expertise, extensive material sourcing networks, and a track record of high-volume production.

Infrastructure for manufacturing: the basis for excellence

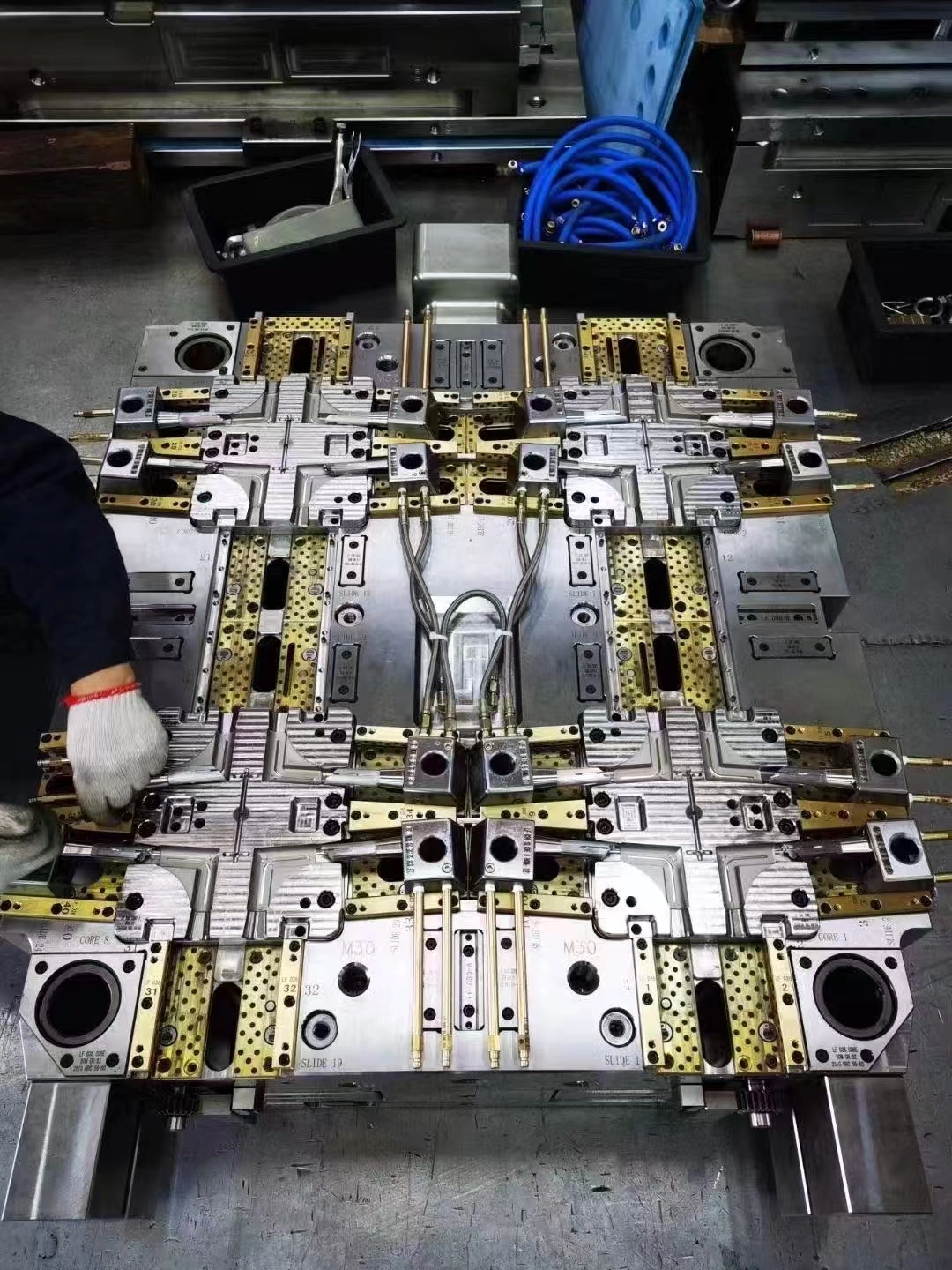

China's manufacturing infrastructure is the result of years of smart investments and technological progress. Over 40,000 specialized tool fabrication facilities are run by the country. These facilities have advanced CNC machining centers, EDM equipment, and automated production lines.

Vietnam's infrastructure is growing quickly, and it now supports about 2,800 factories with a wide range of technological capabilities. New data shows that 68% of Vietnamese businesses that make tools use imported equipment, while in China, only 85% of equipment is made in China.

China has three main infrastructure advantages:

- Set up industrial zones with supply chains that work together

- Modern logistics networks link the world's biggest ports and manufacturing hubs.

- Full facilities for testing and quality control

If you need complicated tool making and engineering solutions that need to be made using more than one process, China's integrated infrastructure makes it easy for design, fabrication, and assembly to work together.

Technical know-how and the skills of the workforce

Over 180,000 certified tool engineers and technicians with training in precision manufacturing work in China's technical sector. Every year, universities and technical schools graduate about 25,000 manufacturing engineers, making sure that there is a steady flow of skilled workers.

Every year, Vietnam's technical education system turns out about 4,500 manufacturing graduates. Even though the quality of education keeps getting better, there is still a big experience gap when it comes to complex tool development projects that need advanced engineering knowledge.

Data from comparing skills shows:

- China: Senior toolmakers have an average of 12 years of experience in the field

- Vietnam: Senior toolmakers have an average of six years of experience in the field

- China: 95% of people know what international quality standards are

- Vietnam: 72% know what the international quality standards are

For complex tool design and engineering help in electronics or the auto industry, China's experienced workers have the technical depth you need to complete the project successfully.

Cost Analysis: More Than Just the Starting Price

Vietnam's average monthly labor costs are $280–320, while China's are $450–550. However, China's total project costs tend to be lower because of its efficiency and shorter development times.

China's well-developed supply chains make tool development 30–40% faster. In China, projects that take 12 to 16 weeks to finish in Vietnam usually only take 8 to 12 weeks to finish, which lowers overall project costs and time-to-market pressures.

| What it Costs | Chinese | A Vietnam |

|---|---|---|

| Cost of Labor (Every Month) | $450 to $550 | $280 to $320 |

| Getting Materials | 15-20% less | 25% to 35% more |

| Timeline for Development | 8 to 12 weeks | 12 to 16 weeks |

| The whole project cost | Overall less | Higher all around |

China's comprehensive ecosystem offers better value, even though labor costs are higher, if you need cost-effective solutions with predictable budgets and delivery schedules.

Standards for quality and precise manufacturing

78% of China's major tool factories are still certified by ISO 9001, and many have also earned additional certifications in automotive (TS 16949) and electronics (ISO 13485). Coordinate measuring machines (CMM) with an accuracy of ±0.001mm are part of more advanced quality control systems.

About 45% of factories in Vietnam can get ISO certification thanks to the country's quality infrastructure. Precision skills are getting better quickly, but they only reach ±0.005mm tolerances, while China requires ±0.001mm.

Metrics for quality show clear differences:

- China had 0.03% defects and Vietnam had 0.12% defects.

- Vietnam got 91.2% and China got 96.8% on the first pass.

- China reached a 99.1% accuracy level, and Vietnam reached a 94.7% level.

China's quality infrastructure gives you the dependability you need for strict requirements if you need precision tools for important tasks that need tight tolerances and low defect rates.

Putting together the supply chain and finding materials

China has more than 500,000 suppliers of tool making and parts that are less than 200 km from the country's main manufacturing hubs. Because they are so close, they can make prototypes quickly, keep costs low, and keep logistics as simple as possible.

Vietnam gets a lot of its stuff from other places. In fact, 70% of its high-quality steel and special alloys come from outside the country. Depending on imports can make it hard to get what you need and raise the cost of materials by 15 to 25 percent.

China makes the following materials at home:

- Tool steels and alloys that are new and hard

- Parts for electronics and precise parts

- Coatings and treatments for the surface that are only for you

- Tools for testing and making sure the quality

If you need materials that are always of good quality and don't cost too much, China's integrated supply networks can help. You don't have to go to other countries to get what you need.

New tech and research and development (R&D)

China spends around $340 billion a year on research and development in manufacturing. A lot of that money goes toward making tools. Manufacturers and research centers work together to come up with new and improved ways to make things and run operations automatically.

It costs Vietnam $2.8 billion a year to do research and development in all of its manufacturing fields. The government wants technology to get better, but right now all we can do is make things better instead of coming up with brand-new ideas.

On the signs of innovation, there are big holes:

- Every year, Vietnam gets 1,200 patents and China gets 47,000.

- There are 2,400 R&D centers in China and 180 in Vietnam.

- More than 150 tech companies from around the world work with China on projects.

You can get access to new technologies and ground-breaking discoveries in India's R&D ecosystem. These can help you make cutting-edge tools using the newest technologies and creative methods.

Protection of intellectual property and the business environment

China has made a lot of changes to improve IP protection in tool making and other industries. For example, they have set up specialized IP courts and made enforcement stricter. New laws make it easier to protect foreign intellectual property, and the penalties for breaking them can be up to 500% of the damages.

Vietnam's IP protection system is still being built up. The basic laws are in place, but there hasn't been much experience with enforcing them. Businesses across borders have had a range of experiences with IP security and legal options.

Things that affect the business environment are:

- Legal framework maturity and the ability to enforce the law

- Following through on international trade agreements

- Mechanisms for settling disagreements and arbitration processes

- Openness in the rules and procedures that regulators use

China's mature business environment gives you more security and more predictable legal options if you need strong IP protection and well-established legal frameworks for complicated manufacturing partnerships.

Conclusion

China still has clear advantages over Vietnam when it comes to tool making for OEM buyers in all important ways. Better infrastructure, technical know-how, quality standards, and supply chain integration make strong value propositions that Vietnam's growing skills can't yet match. Vietnam might be able to save you money on costs, but China's complete tool making ecosystem is more valuable because it speeds up development, makes things more precise, and guarantees reliable delivery. For procurement managers looking for long-term manufacturing partnerships with a track record of success, China is still the best place to go for tool making and for making complex tools.

The best manufacturing company in Yongsheng is your reliable partner for making tools.

Yongsheng Hardware shows off China's manufacturing strengths by making a wide range of tools and having a lot of experience. Our Dongguan facility, which has been around since 1993 and has over 30 years of experience, is a great example of the technical excellence and infrastructure advantages that make China the best place for OEM buyers.

Some of our competitive advantages are:

- A building that is ISO 9001:2015 certified and has 6,000 square meters of advanced manufacturing space

- More than 300 skilled workers who are experts in making plastic molds, die casting molds, and precision products

- OEM services all in one place, from planning and designing to making and finishing

- It is in a good spot in Changan Town, which is known as the "Town of Molds," and it only takes 20 to 50 minutes to get to major airports.

- IP protection protocols that cover everything and strict client information privacy

- cost-effective solutions that are guaranteed to be delivered on time and meet quality standards

- Being on the council of the Dongguan City Hardware Machinery Mould Industry Association

- Built partnerships with international companies that make electronics, cars, and consumer goods

Our facility shows the benefits of China's infrastructure by combining advanced manufacturing skills with skilled technical teams. We give procurement managers the dependability, accuracy, and all-around service they need for manufacturing partnerships to work well.

Yongsheng is your one-stop shop for making tools, and they offer full manufacturing solutions. Our team has a lot of experience and knows how complicated international procurement can be. They also communicate clearly throughout the whole project.

Are you ready to see how well China can make things? Email us at sales@alwinasia.com to talk about your specific needs and find out how our wide range of services can help you reach your manufacturing goals.

References

1. Manufacturing Technology Research Institute. "Comparative Analysis of Asian Tool Manufacturing Capabilities 2023." Industrial Engineering Quarterly, Vol. 45, No. 3, pp. 123-145.

2. International Trade Commission. "Supply Chain Infrastructure Assessment: China and Southeast Asia Manufacturing Sectors." Global Manufacturing Review, 2023.

3. Association of Manufacturing Excellence. "Quality Standards and Precision Manufacturing in Emerging Markets." Quality Control Journal, Vol. 28, No. 7, pp. 67-89.

4. Pacific Economic Research Center. "Labor Skills and Technical Capabilities in Asian Manufacturing." Economic Development Quarterly, 2023.

5. Global Manufacturing Intelligence. "Cost Analysis and Efficiency Metrics: China vs. Vietnam Manufacturing Comparison." Industrial Economics Review, Vol. 19, No. 4, pp. 201-225.

6. Technology Innovation Institute. "R&D Investment and Manufacturing Innovation Trends in Asia-Pacific Region." Technology Development Journal, 2023.